Why Do Auto Insurance Rates Go Up?

November 14, 2023

Topics:

InsuranceGenerally speaking, you have to pay car insurance. But what causes your auto insurance rates to go up?

Introduction

Car insurance is a requirement in most states, whether you think you need it or not. But when the price seems to keep rising, it can be pretty frustrating. Luckily, if you know what causes your auto insurance rates to go up, you can be prepared to deal with it — or even prevent it.

Reasons Why Car Insurance Rates Go Up

Economic conditions can cause rates to go up across the board. But beyond that, the main reasons insurance rates go up are things you can control yourself. It could be because you got in an accident, were caught speeding, or you added something to the policy. Here’s what generally does (and doesn’t) cause your insurance rates to rise.

- Moving violations like speeding tickets, especially if combined with a DUI, can often cause your rates to increase because your insurance company sees you as a greater risk.

- Non-moving violations, like parking tickets, usually won’t affect your rate.

- Traffic accidents will almost always affect your rate, even more than speeding. In some states, it doesn’t even matter if you caused the accident or not — just if you were in it.

- Driving more increases the chance of an accident, so if your odometer rises sharply, so will your rates.

- Upgrading your car to a newer model is almost guaranteed to increase your insurance rate because newer vehicles are worth more.

- The color of your car does not have an effect, no matter what your great-uncle tells you.

- Adding another driver, like your spouse or your teenager, will definitely cause the rate to go up.

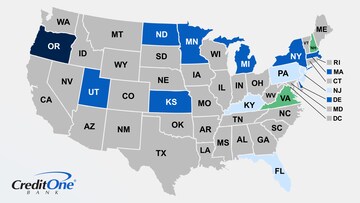

- Moving to another state or zip code could cause a rate increase (or decrease) because rates change depending on where you live.

- Your credit score can affect your car insurance rate in nearly all states, because many insurance companies use this as a calculating factor.

Does Inflation Affect Car Insurance?

Even if you haven’t done anything wrong or changed anything about your car insurance policy, your rate can still go up over time. It’s for the same reason the prices of everything go up: inflation, combined with other economic conditions across the country. Some of those other conditions beyond your control include weather disasters and climate change, because an increase in floods and wildfires leads to more claims.

To add insult to injury, the price of gas (and electricity) generally rises at the same time as insurance rates. So your morning commute can get a lot more expensive, all at once, whether you drive a gas-powered car or an electric vehicle. The price of cars has also gone up, partially because of inflation, but additionally because they have become more advanced with a lot more technological features. More expensive cars mean higher insurance rates.

Keep in mind that you’re not the only one feeling the crunch here. Costs of parts and services also rise for auto manufacturers, mechanics who have to repair cars, and everyone else up and down the chain. Ultimately the consumer ends up paying the price, one way or another.

Bottom Line

Car insurance rates are usually rising all on their own, thanks to inflation. On top of that, getting in an accident or being cited for a moving violation will impact your personal auto insurance rates. And finally, getting a new car or adding another driver is likely going to cost you more for insurance coverage.

One way to combat your insurance rates directly is to look for every possible discount you can find, whether that’s for a good driving record, downloading your insurance company’s app, bundling car and home insurance, paying annually instead of monthly, or any number of things they can offer you. Comparison shopping between insurance companies is also a good plan.

To combat your rates indirectly, look for ways to save on gas prices, like signing up for a gas chain’s loyalty program or using a credit card that gives high cash back rewards on gas purchases. Some travel cards also give elevated rewards on gas. So even though you’re not getting a discount on your insurance, you’re getting back a portion of what you spend on personal transportation. Just make sure you pay off your credit card bill each month so you don’t get dinged with interest charges, which could wipe out the benefits of your rewards.

For over a quarter of a century, Heather has been working as a journalist in all media: TV, radio, print, and online. After establishing her career in Toronto, she has been living, working, and playing in Las Vegas for the past decade. She loves pulling apart complicated topics to make them simple, fun, and easy to understand, especially in the business and financial niches. But she also enjoys writing about the personal side of life, including success, relationships, families, and pets. She approaches everything from a yin-yang perspective, so her passion for wordplay and entertaining metaphors is always balanced with an intense (and some would say annoying) focus on facts and accuracy.

This material is for informational purposes only and is not intended to replace the advice of a qualified tax advisor, attorney or financial advisor. Readers should consult with their own tax advisor, attorney or financial advisor with regard to their personal situations.

Credit One Insurance Agency, LLC’s services are not available in all states.