What Is the Minimum Car Insurance Required by State?

October 23, 2023

Topics:

InsuranceAuto insurance is mandatory in almost every state. But how much do you actually need? Here’s a state-by-state breakdown.

Introduction

When you buy a car, the purchase price is just the beginning. Then you have to pay for annual registration, gas, parking, and yes, auto insurance. It’s important to know exactly what your state requires as the minimum amount of insurance you can legally drive with, what those minimums cover, and what additional options you have.

Understanding Required Coverages

Each state has different minimum car insurance requirements, but they all use the same category types to list out what those minimums are.

Liability insurance

Liability insurance covers other people’s losses if you cause an accident. There are three main types of liability insurance, typically listed in order with a slash between each one:

- Bodily injury coverage per person

- Bodily injury coverage per accident

- Property damage coverage per accident

The coverage limits are in the thousands, but they’re written as the base number — for example, 25/50/25 means bodily injury limits of $25,000 per person and $50,000 per accident, as well as a $25,000 property damage limit per accident.

Let’s break down each one.

a) Bodily injury (BI) liability

If you cause an accident, bodily injury liability coverage helps pay for medical expenses to treat the other person’s injuries, whether it’s another driver or a pedestrian. It may also cover your legal fees if they sue you.

BI liability is in two parts — per person and per accident. So if you cause one accident that injures three people, you have coverage limits for each of those people, and a total amount for the accident. 25/50/25 would cover up to $25,000 per person, but only $50,000 per accident. So you wouldn’t have enough coverage if each person had $25,000 in medical expenses.

b) Property damage (PD) liability

If you cause an accident that damages another person’s vehicle or other property, PD liability covers their repair costs, up to your coverage amount.

Additional insurance requirements

Besides liability insurance, which is required in almost every state, some states have additional coverage requirements.

a) Uninsured/Underinsured motorist coverage (UM/UIM)

If another driver causes an accident that you’re involved in, but they don’t have auto insurance — or not enough insurance to cover your losses — that’s where your uninsured or underinsured motorist coverage comes into play. It also covers hit-and-run accidents where you don’t know who was driving.

An uninsured motorist who doesn’t flee the scene will probably be charged a fine when you report the accident, and you usually have the option to sue them for damages. But you can’t get water from a stone, so if you have UM and/or UIM coverage, your insurance can pay for your own property damages or injuries. Almost half of the states require UM or both UM and UIM coverage, and you can typically get it as an option in the rest.

b) Personal injury protection coverage (PIP)

PIP coverage can pay for your own or your passenger’s medical bills, rehabilitation, lost wages, and even childcare — whether you caused the accident or not. This coverage is required in nearly all the no-fault states, which we’ll look at more closely in the next section. It can also be purchased in some other states.

c) Medical payments coverage (MedPay or MP)

Medical payments coverage, more commonly called MedPay, helps cover medical expenses if you’re injured in an accident. It’s similar to PIP, but it usually only covers medical costs. The only exception is Pennsylvania, where MP is required … but coverage there also includes lost wages, similar to most PIP plans. One other state that requires MP is Maine. Generally speaking, if the state requires PIP, MP is not available, but in all other states it’s an option.

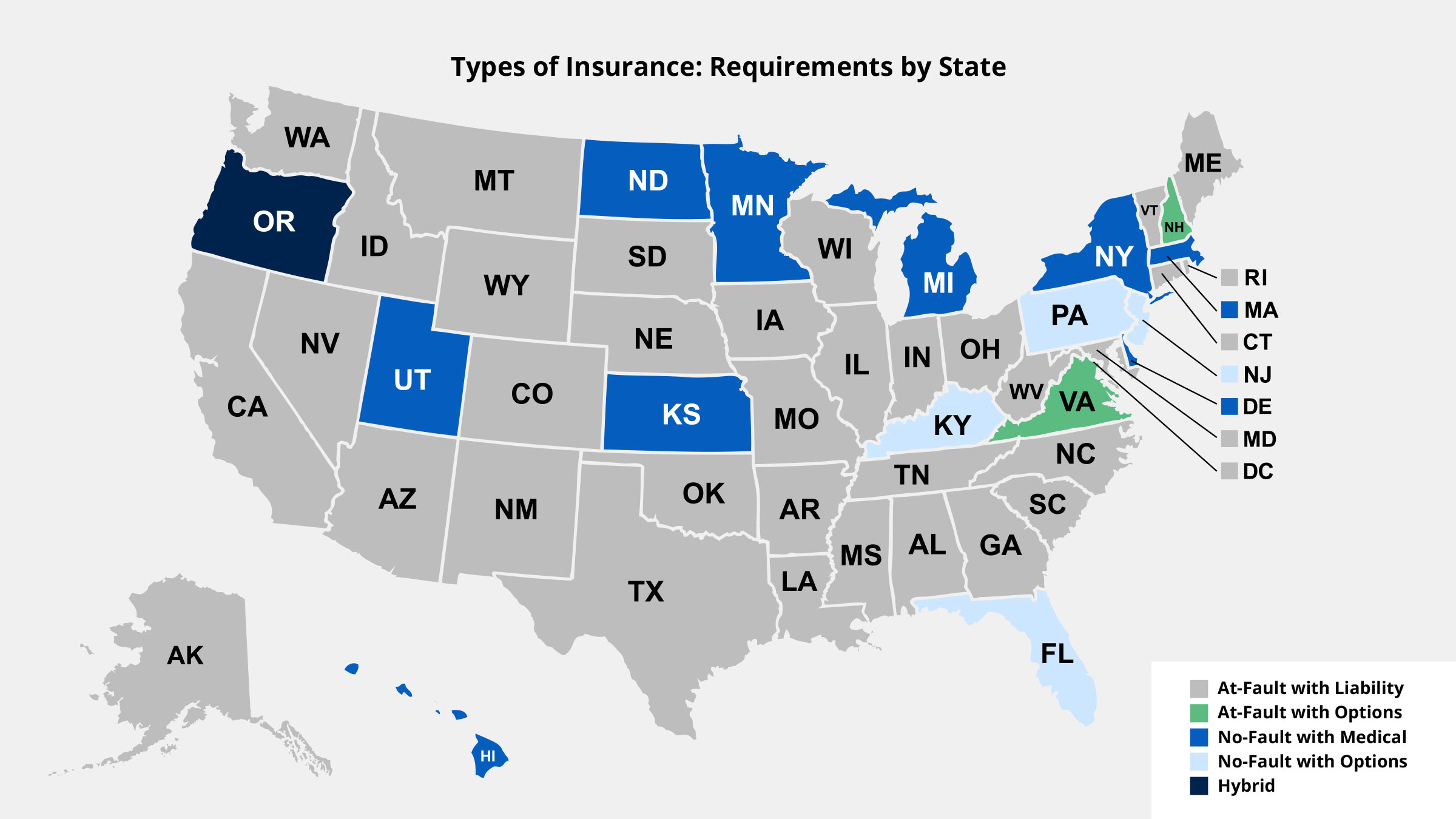

At-Fault vs No-Fault States

In approximately 75% of states, if you cause the accident, you’re liable for any damages or injuries to other drivers and passengers. That’s referred to as an “at-fault state” — you caused it, it’s your fault, so you pay. Or, well, hopefully your insurance pays most (or all) of it.

The other 25% or so are “no-fault states” where it doesn’t matter who caused the accident, because everyone files their own claims. The no-fault states, in alphabetical order, are Delaware, Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania and Utah.

Most of those states require you to have personal injury protection (PIP) coverage. Kentucky, New Jersey and Pennsylvania let you opt out of PIP coverage if you sign a waiver or pay a fee. Oregon is an at-fault state that also requires PIP, making it a hybrid state.

States That Don’t Require Car Insurance

Almost every state requires some level of car insurance, even though minimums and types of coverage vary. But there are a few exceptions.

- New Hampshire is the only state where car insurance is totally optional. However, if you choose not to get it, you have to prove you have enough money to cover the minimum financial responsibility requirements if you do cause an accident. That’s $25,000 in bodily injury per person, $50,000 in bodily injury per accident, and $25,000 in property damage.

- Virginia allows you to opt out by paying an uninsured motorist fee of $500 a year. But you’re still responsible for paying damages if you cause an accident, because it’s an at-fault state.

- Florida is the one state that does mandate insurance but doesn’t mandate liability coverage for bodily injury. The only liability coverage you need to have in Florida is for property damage. But it’s a no-fault state, so you do also need PIP.

Keep in mind that if you drive out of state, you generally need insurance in those other states. Opting out in your home state doesn’t cover you anywhere else.

Optional Coverages

If you don’t feel like your state’s minimum car insurance requirements are enough, you can consider additional optional coverage.

- Increased liability coverage: Many specialists recommend getting more than the minimum, like 100/300/100. That reduces the chance of getting slapped with a large bill if you don’t have enough coverage.

- Full coverage: Also called comprehensive insurance, this option covers liability as well as vandalism, theft and natural disasters. It’s never required by the state, but it’s sometimes required by a lender if you’re financing or leasing a car.

- Guaranteed asset protection (GAP) coverage: GAP helps pay off your car loan if your vehicle is stolen or totaled and you still owe more than the car’s depreciated value. Lenders sometimes require this as well.

- Collision insurance: This option pays for your car repairs if it’s damaged in an accident, even if there was no other car involved. That includes colliding with an object like a tree, fence, or shopping cart.

Additional optional categories include:

- Mechanical breakdown insurance

- Windshield or full-glass insurance

- Rental reimbursement insurance

- Emergency roadside assistance

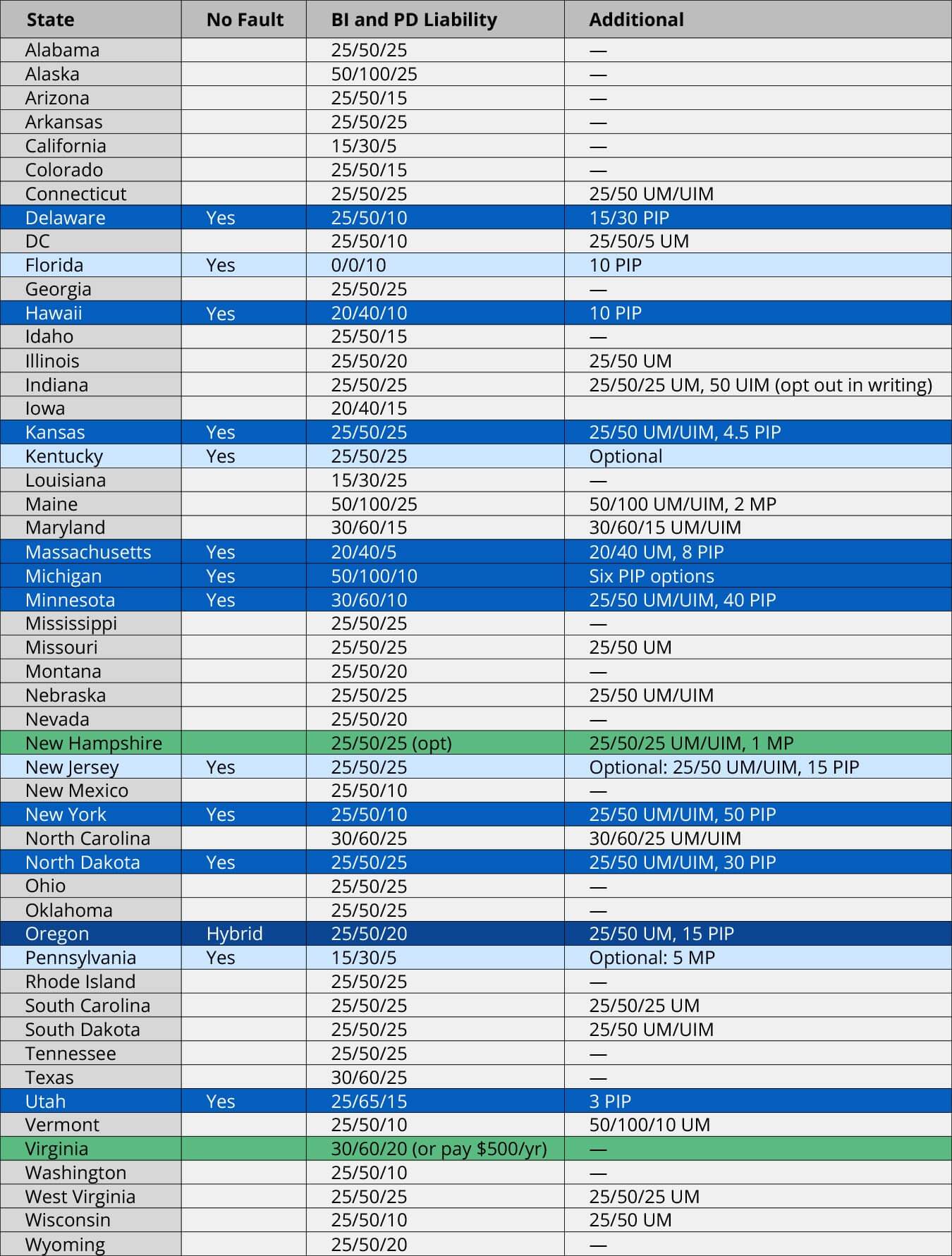

Minimum Car Insurance Requirements by State

Here’s a breakdown of all the minimum state requirements for liability and additional coverage, as well as whether it’s a no-fault state or not.

In the following chart, all numbers are in the thousands.

Bottom Line

If you live in a state that requires car insurance, you need to have it. Period. And if your state doesn’t require it, you have to be aware of the repercussions of not getting it.

If you’d like to compare rates among more than 40 top companies to make sure you’re getting the best deal for you, use the free tool at Credit One Insurance.

For over a quarter of a century, Heather has been working as a journalist in all media: TV, radio, print, and online. After establishing her career in Toronto, she has been living, working, and playing in Las Vegas for the past decade. She loves pulling apart complicated topics to make them simple, fun, and easy to understand, especially in the business and financial niches. But she also enjoys writing about the personal side of life, including success, relationships, families, and pets. She approaches everything from a yin-yang perspective, so her passion for wordplay and entertaining metaphors is always balanced with an intense (and some would say annoying) focus on facts and accuracy.

This material is for informational purposes only and is not intended to replace the advice of a qualified tax advisor, attorney or financial advisor. Readers should consult with their own tax advisor, attorney or financial advisor with regard to their personal situations.

Credit One Insurance Agency, LLC’s services are not available in all states.