The Social Status of Credit: How Millennials & Gen Z View Credit Scores

October 20, 2025

Topics:

Credit ScoreWhat’s in a number? Find out how adults from two distinct generations factor in credit scores and financial habits as they assess relationships.

In this article:

- Introduction

- Key Findings

- Credit Score Literacy Is High, But Disclosure Stays Low

- Performance Spending: Appearances, Gifting, and Going Broke to Impress

- Friends, Finances, and the Boundaries of Generosity

- Thanks, But No Thanks: 53% Are Determined to Be Financially Independent

- In Finance We Trust: Who Young Consumers Turn to for Financial Advice

- Financial Reputation = Self-Worth? Only 1/3 Feel Proud of Their Financial Standing

- Methodology

Introduction

"Would you date someone with bad credit?" It’s a question that younger generations are asking more often as money matters reshape modern relationships. Once considered private, credit scores now influence everything from first dates to lifelong commitments. To understand this shift, we asked 1,000 Gen Z and millennial adults1 how credit scores shape their romantic lives, friendships, and even family ties.

Key Findings

- Nearly 70% of consumers would lose confidence in a boss with bad credit or major debt

- More than half say a high credit score makes someone more attractive

- 1 in 2 people admit to faking their wealth or success

- Over 25% of Gen Zers and millennials acknowledge they don’t fully understand credit scores

- Over 70% of women almost never discuss money with their friend groups

- Nearly 50% of men would be willing to go into debt on a date

- Women are twice as likely to say “I don’t” due to poor financial habits

Credit Score Literacy Is High, But Disclosure Stays Low

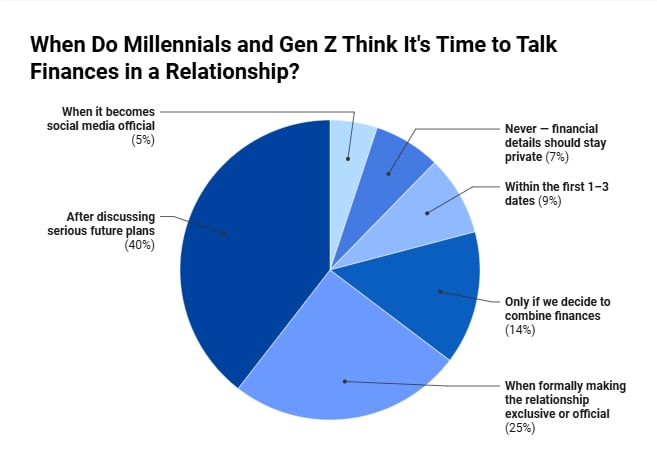

73% of Gen Zers and millennials say they fully understand what a credit score is and how it impacts their life. But when it comes to sharing that information, many stay tight-lipped: 54% would rather not disclose their credit score or financial situation to a romantic partner until the relationship turns serious.

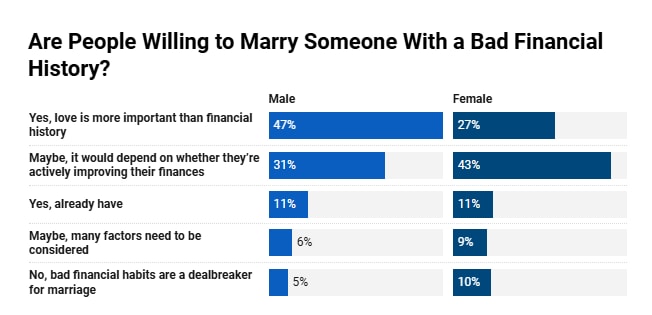

For 3 in 4 young adults, a bad financial past doesn’t mean marriage is off the table

Only 8% of young consumers say poor financial history is a marriage dealbreaker, proof that love still wins. Nearly half (48%) say they would marry — or already have married — someone with a shaky financial past, and 37% say they’d consider it if the person was actively turning things around.

Men (47%) are more likely than women (27%) to overlook a partner’s financial past in the name of love. In contrast, women are twice as likely to call it a dealbreaker (10% versus 5%).

Still, financial habits can strain even the strongest bonds: 21% would end a relationship over repeated money mistakes, while 23% say poor financial behavior wouldn’t affect their relationship at all.

And ultimately, millennials and Gen Zers still think someone’s personality is the top factor for choosing a partner:

More than half say a high credit score is attractive

Forget charm or a great smile — try a 750 FICO score. Over 50% of people say a high credit score makes someone more attractive, proving that in today’s dating world, financial finesse might be a necessity when seeking a potential partner.

But a low score isn’t a universal dealbreaker. While 24% of respondents shrug off credit scores entirely when it comes to dating, another 24% set the bar at 700 or above before even considering a serious relationship. That leaves a sizable chunk of singles for whom financial health isn’t just important; it’s essential. For those looking to make the cut, brushing up on credit basics might be more useful than another gym session.

Should love be credit-rated?

Would you swipe right…if you knew their credit score? One in five people (20%) say yes, they want dating apps to show credit scores and financial habits upfront. But the majority (55%) say no way, calling it too invasive or too judgmental. This is especially for those making less than $50,000, where 3 out of every 5 give this a hard pass.

Interestingly, wealthier daters seem more open to full financial disclosure. Among those earning over $150,000, nearly a third (32%) want this kind of transparency, but only 15% of those making less than $50,000 feel the same. So while some are curious about your credit karma, others would rather leave financials out of their bios.

Performance Spending: Appearances, Gifting, and Going Broke to Impress

In today’s world of perfectly curated Instagram feeds and swipe-right dating culture, money is part of the show. Gen Z and millennials often feel pressure to look financially successful, even when their bank accounts say otherwise. The result? A generation caught between financial caution and social performance, trying to balance real-life budgets with online appearances.

Half of Gen Z admits to flexing their finances

For over half of Gen Z and millennials (51%), looking rich has become part of the dating game, even if it means faking it. Gen Z leads the pack with 54% admitting to lying or exaggerating about their financial success, compared to 48% of millennials.

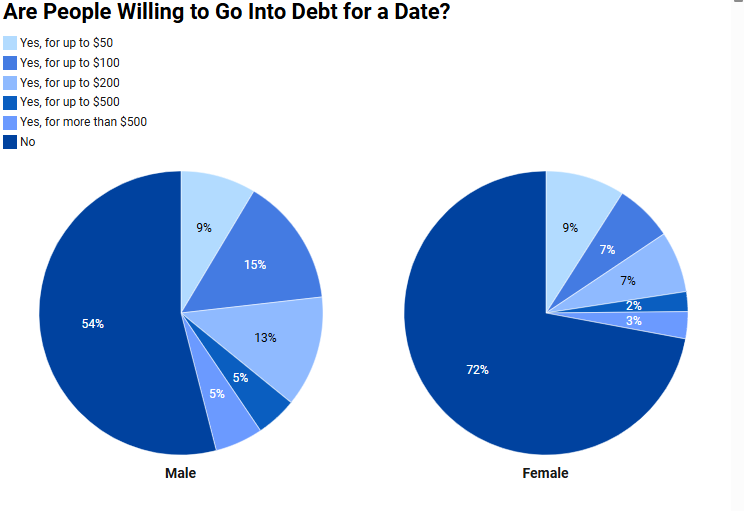

But the illusion comes at a cost. A staggering 37% of respondents say they’d be willing to overdraft their account or even go into debt just to impress a date. It’s financial theater, and for many, the price of admission is far too high.

Though almost half of men are willing to overdraft their account or go into debt to impress a date, only a mere 28% of women would do the same.

Almost half of men would go into debt to impress a date

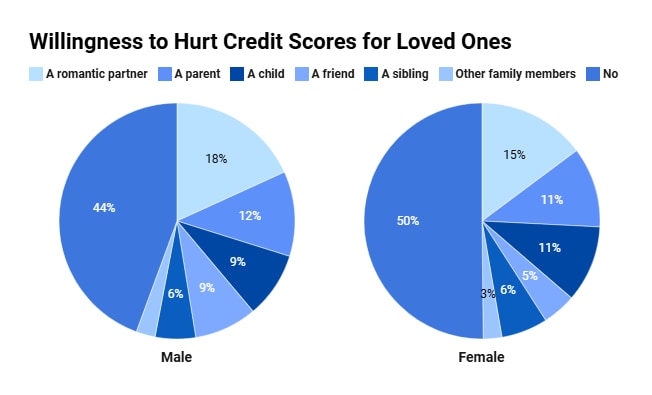

Love might be blind, but apparently, it isn’t budget conscious. A bold 38% of people admit to going into debt or damaging their credit score just to impress someone. For 22%, that someone was a romantic partner.

Men, in particular, are feeling the financial pressure of courtship — 41% admit they’ve taken a credit hit for love, compared to 35% of women. And when it comes to going all-in for a single date? Nearly half of men (46%) say they’d willingly overdraft their accounts to impress, versus only 28% of women. It's chivalry with a credit card swipe, and it’s getting costly.

Friends, Finances, and the Boundaries of Generosity

Gen Z and millennials are all about loyalty and lifting each other up, but when it comes to giving or receiving financial advice? That’s where things get a little awkward. These generations value their relationships deeply, so they tread carefully, offering support without overstepping and respecting boundaries even when they see a financial red flag waving.

Half claim “Money doesn’t matter” ... But for the rest, it might

For 56% of people, a friend’s finances don’t influence the friendship at all. But when it comes to talking about money? It’s still a bit of a no-go. Nearly a third (32%) say they never discuss finances with close friends, while only 11% talk about it frequently. However, 70% of women say that they almost never talk about money with their friend groups, but just under 60% of men say the same.

In romantic relationships, though, the money talk is alive and well. A strong 67% discuss finances with their partner at least monthly, 44% weekly, and 10% check in daily. So while money might not “matter,” it’s clearly part of the deeper conversations that sustain real connection.

Young adults want to help friends in financial crisis

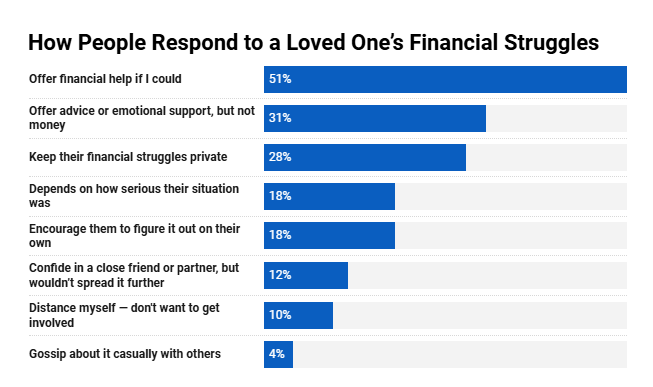

Despite the awkwardness of money talk, most young adults are ready to step in when it counts. If a friend or family member were struggling, 51% say they’d help if they could, and 59% say they’d do it out of genuine care, not obligation.

Bad advice, hurt feelings, and the high cost of friendship

When friends give bad financial advice, however, forgiveness has its limits. One in three (32%) say they’d forgive but stay cautious, while 23% would blame themselves for taking the advice. Another 20% say they’d confront the friend, and 2% admit they’d try to get even.

Thanks, But No Thanks: 53% Are Determined to Be Financially Independent

Getting help from family, like a little boost with rent or covering an emergency bill, is common for Gen Z and millennials. But while the support is appreciated, it can be a bit of a pride bruiser.

Despite the looming threat of a recession, over half of young consumers are determined to maintain financial independence, regardless of the cost. For those who wouldn’t mind a helping hand, 27% are hopeful that family and friends can step in, while 20% are doing their best to find a romantic partner for the support they need.

Hard times, harder choices

Even in tough times, 40% say a worsening economy wouldn’t impact who they choose to build relationships with. But 1 in 5 would prioritize financially stable romantic partners, and another 20% say financial stability would become a priority in both romantic and platonic relationships.

In Finance We Trust: Who Young Consumers Turn to for Financial Advice

From loved ones to ChatGPT to professionals, there’s an almost overwhelming number of sources for financial advice. But, of course, everyone has a favorite that they’ll turn to before anything else:

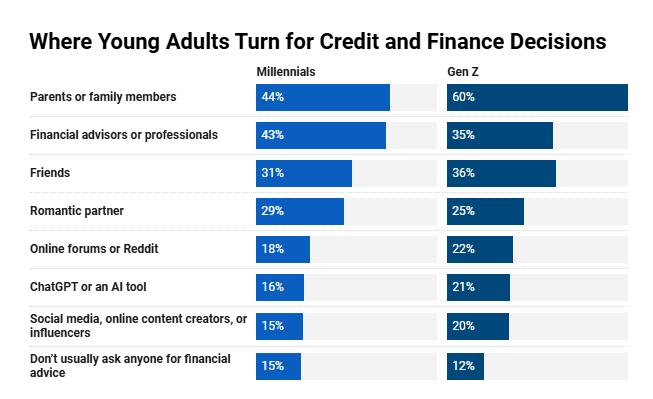

Being digital natives, some Gen Zers whip out their smartphones for financial advice, looking to Reddit and influencers on social media; 21% even get some help from ChatGPT. Even still, 60% prefer to get help from their parents.

Though technologically fluent, millennials tend to get their financial advice offline. Parents are the top source, though at a much lower rate than Gen Z (only 44%). Millennials are also far more likely to consult a professional for financial advice (43% versus 35%).

43% would lose confidence in a boss with bad credit

It’s not just personal relationships; financial reputation matters at work too.

43% of consumers would lose some confidence in a boss with bad credit or serious debt. Of those, 26% say they’d lose a little faith, while 18% say they’d seriously question their leadership.

However, 37% wouldn’t change their view, and 20% say they’d actually admire their transparency. Turns out, honesty (and maybe some resilience) still goes a long way.

Financial Reputation = Self-Worth? Only 1/3 Feel Proud of Their Financial Standing

Personal finances are just that: personal. Money can bring up intense feelings, ranging from shame to pride, that can feel even more powerful when finances are put on display for all to see.

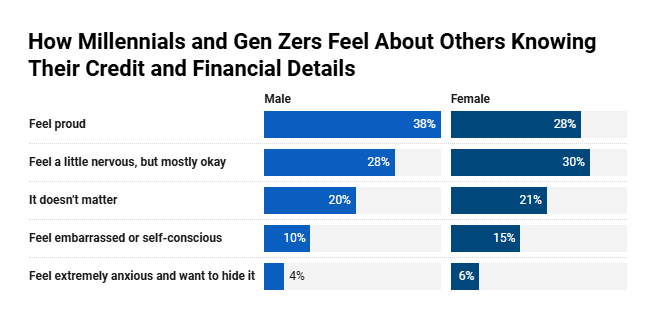

Here’s how young consumers would feel if loved ones learned the details of their finances:

This is another area where men and women differ. Men are more likely to feel proud (38%) and less likely to feel embarrassed about their finances (10%), while the opposite is true for women (28% and 15%, respectively).

Meanwhile, only 22% of people making less than $50,000 per year would feel proud if others learned about their financial situation, and over half (56%) of those making more than $150,000 per year claim they would.

In today’s world, your credit score might be doing more flirting than you are. Sure, personality still tops the list, but many people are also seeing the allure of a solid score. At the same time, many young adults are juggling real financial stress, social media pressure to “look successful,” and a deep desire to stay independent. But one thing’s clear: whether it’s love, friendship, or career moves, money matters — and talking about it (even awkwardly) might just be the glow-up we all need.

Find the full survey and responses here.

Methodology

We surveyed 1,000 Gen Zers and millennials across income levels and regions in order to get a glimpse of how financial habits and credit affect social status and perceptions in the United States. The survey demonstrated both broad trends and more nuanced insights about the perspectives and actions of these younger generations.

Fair Use Policy

We encourage readers to share and reference the insights from this study for noncommercial purposes, including in blog posts, academic papers, and social media content. If you’d like to quote or cite this article, please include a clear link back to this page as the original source. You may not reproduce the full text, images, or graphics from the article without permission. For journalists or publishers interested in covering our findings in a news story, please ensure proper attribution and provide a link to the original study. For commercial use or licensing inquiries, please contact us directly.