Featured Article

Trends and Factors Affecting Generational Financial Trauma

The financial experiences people have early on, whether positive or negative, shape their relationships with money for life. They can affect how people handle paycheck deposits, savings accounts, bills, and credit cards well into adulthood.

Continue Reading

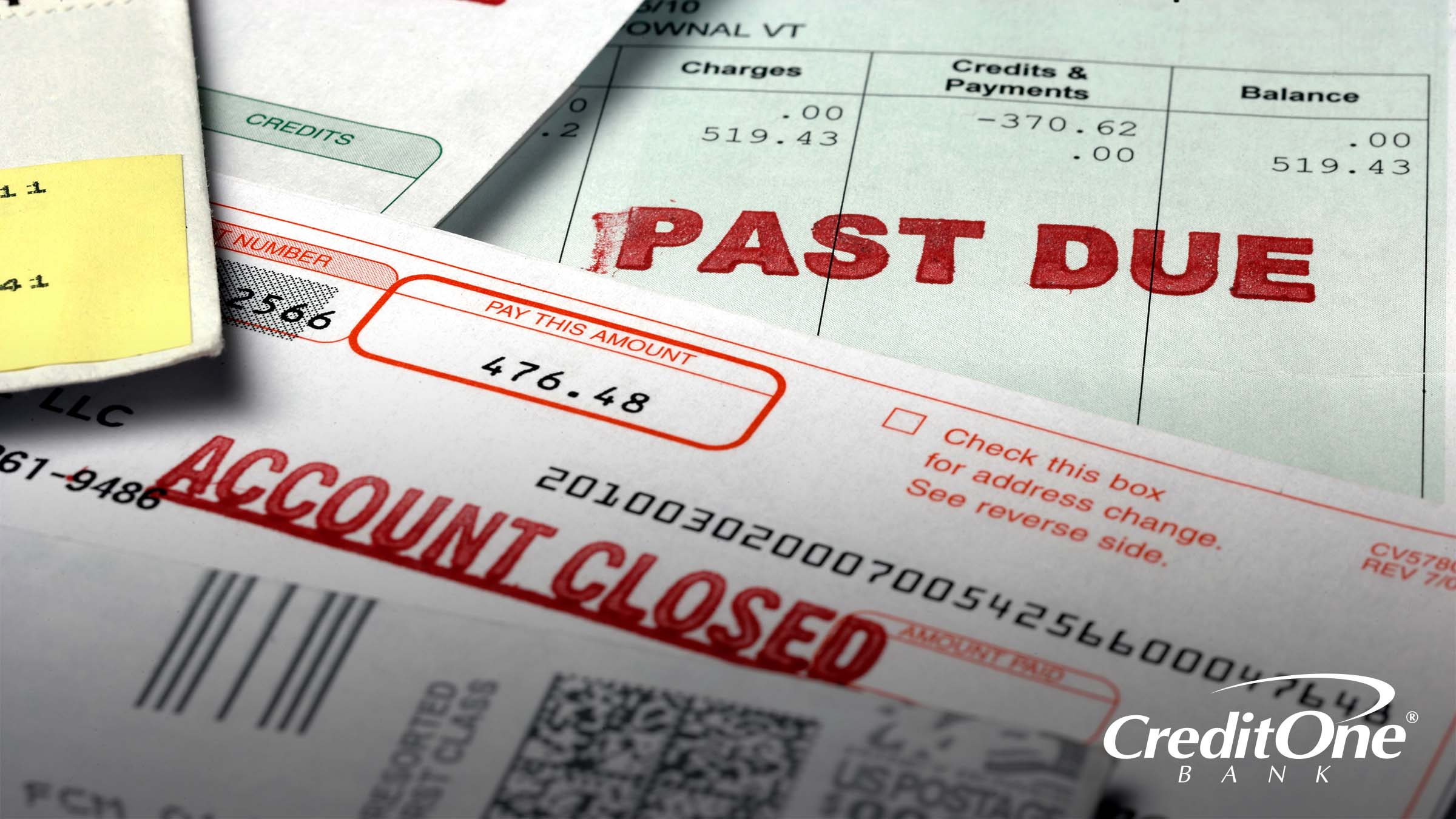

What Is a Charge-Off?

Household credit card debt rose by $38 billion in the third quarter of 2022, reaching $0.93 trillion—which represents a 15% year-over-year increase of $121 billion—according to the Federal Reserve Bank of New York. Almost 3.7% of those credit card balances are now seriously delinquent, which means 90 days or longer past due.

What Do You Need to Open a Bank Account?

Whether you’re opening your first bank account or you’ve had several before, it’s good to know what you need to take to the bank (or your computer) before starting the process. Several official documents are usually required—like official ID and proof of residence—as well as an initial amount of money to deposit.

This material is for informational purposes only and is not intended to replace the advice of a qualified tax advisor, attorney or financial advisor. Readers should consult with their own tax advisor, attorney or financial advisor with regard to their personal situations.