5 Ways to Make the Most of Your Money

July 07, 2025

Money is one of your most valuable assets. Discover 5 ways to make the most of your money so it goes as far as possible.

Introduction

Life is full of unexpected events, and it’s normal to find yourself ducking a few curveballs. But developing healthy spending habits and practicing smart saving can make it easier to plan for the future, take control of your finances, and work toward greater stability.

If that all sounds easier said than done, you can follow a few tried-and-true strategies to make your money go further.

Create a Spending Plan and Budget

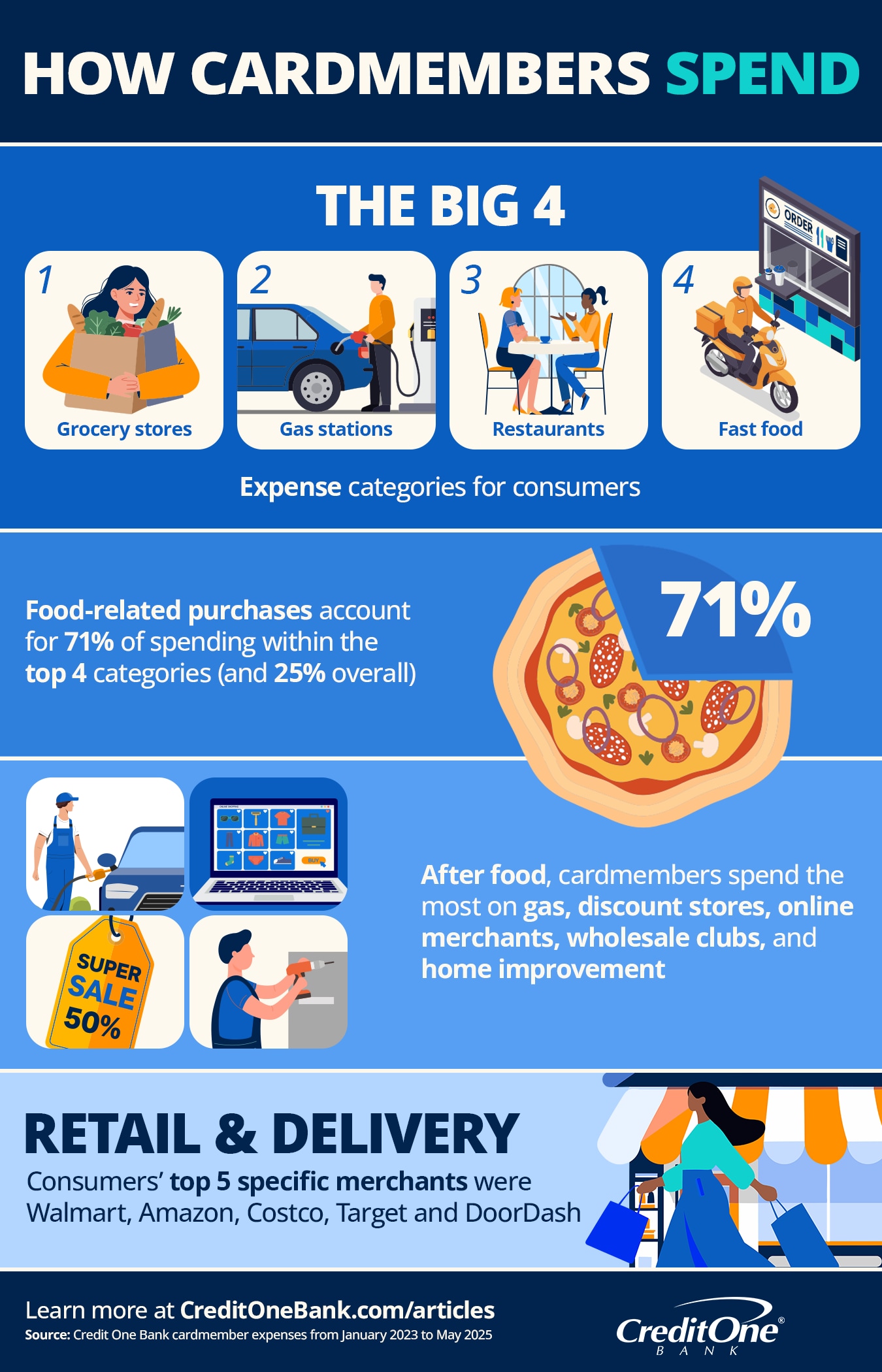

Most people hate the thought of making a budget, but it’s an excellent tool for staying on track financially. By building a budget and examining your spending habits, you should be able to see exactly how much money you have coming in and going out, as well as where — or on what — you’re spending it.

This is often the first step toward meeting both short-term and long-term financial goals, whether they involve taking a vacation, paying off debt, buying a new house, or saving for retirement.

Start by adding up your household income, including paychecks, side hustles, investments or rental property. Next, figure out your monthly expenses, starting with recurring bills like rent or mortgage, car and other loan payments, insurance, utilities, and subscriptions. Then account for variable expenses like gas, groceries, and entertainment.

Once you have your income and expenses calculated, look for places you may be able to cut back to help meet your financial goals. Don’t forget to be flexible; your budget and spending will likely change along with your needs and situation.

Compare Rewards and Interest Rates

You can stretch your budget further by using financial products that align with your needs. That includes choosing the best rewards programs and best interest rates you can qualify for.

Better rewards programs from credit cards

It’s becoming more and more common to find credit cards that provide attractive rewards, like cash back or points, when you use that card for eligible purchases. Taking advantage of those credit card rewards helps you get more out of what you buy. And you can even maximize your credit card rewards by using whichever card earns you the best return for each purchase.

Like with most things, it’s a good idea to shop around for the best deal. You want to compare the cards available to you, and pick the best rewards program you can get. It’s easy to let a flashy sign-up bonus dazzle you, but look beyond that to consider your long-term everyday spending habits. Ideally, you want a card that continues to give you value for years to come.

Lower interest rates on credit cards and loans

The interest rate you have to pay is often based on your credit score. Typically, higher credit scores mean lower rates, and vice versa. But the first goal should be to choose the lowest rates you qualify for. And the second goal is to improve your credit score so you can get better rates in the future.

A caveat here is that if we’re talking about credit cards, and if you plan to always pay your full balance during your grace period, you may never have to pay interest. But if something happens and you need to carry a balance, you want to have a good rate. And most loans will require some type of interest as well.

Once you have a loan or credit card in your name, be sure to make your payments on time, every time. Your payment history is the one factor with the biggest impact on your credit score. Next is your credit utilization ratio, which measures how much of your available credit you’re using at any given time. Spoiler alert: experts recommend only using 30% or less of your credit line (and no, that’s not a typo).

Higher interest rates on savings accounts

When you’re paying interest, you want the lowest rates. But when you’re earning it, you want the highest. So for savings accounts, certificates of deposit (CDs), and other financial accounts that pay you interest, always look for the highest rates you can find.

The cool thing is that savings products don’t usually consider your credit score. Everyone has access to the same offers, as long as they can meet any minimum deposit requirements. So look for the highest-yield savings account you can find, and factor in any introductory rates that may expire after a set period of time.

You might be able to get a better rate with a CD, but the trade-off is that you have to agree to leave your money untouched for the full term, which may be a few years. Savings accounts tend to give you easier and quicker access to your funds. Once you weigh the pros and cons against your own needs, you can pick the best one for you.

Keep in mind that digital banks can often provide higher interest rates than traditional brick-and-mortar branches because they have lower overhead costs. But make sure any bank you consider is a member of the Federal Deposit Insurance Corporation (FDIC), so your money is protected by the government — up to $250,000 per account owner per insured bank.

Build an Emergency Fund

Emergency funds create a financial buffer that could help keep you afloat in times of need. This money can be used to pay for unexpected expenses such as medical bills, car repairs, home appliance repair or replacement, and unforeseen circumstances like a job loss or death in the family. A good rule of thumb is to put aside three to six months’ worth of living expenses.

To build your emergency fund, set a monthly savings goal. Even a small amount, like $50 per paycheck, can make a big impact over time. The easiest way to do this is to set up an automatic transfer to your emergency fund account each time you get paid. Then check on the account periodically so you can adjust how much you’re contributing if necessary — or when your budget allows.

Keep Track of Your Credit

Your credit score provides potential lenders and other parties a quick way to get a better idea of your financial history and your ability to pay. Having a good credit score may result in better interest rates and make it easier to get approved for loans, rent an apartment, take out a mortgage, or finance large purchases. Poor credit could saddle you with higher interest rates, less favorable loan terms, or even result in your loan or credit card application being denied.

To help you figure out how different actions affect your credit score, many online sites — including banks and credit card companies — offer free credit scores and financial tools. These can help you understand your situation and track your score over time. Just be sure to check reviews and verify a site’s legitimacy before entering your personal information.

Take Advantage of Emerging Technology

Credit and debit cards have been around for decades and continue to grow in popularity. Convenience is just one of the benefits credit cards offer over cash. As card technology becomes more advanced, so does the security they offer. More secure transactions can save you money, time, and headaches by helping prevent identity theft or unauthorized purchases.

- EMV chip cards use smart technology to store data on the embedded microchip. Then they provide an extra level of security by generating a one-time code for each card transaction. So even if a hacker stole the data from an EMV point-of-sale transaction, they wouldn’t be able to use that information to clone fraudulent cards. As a result, inserting an EMV chip into a card reader is more secure than swiping the magnetic stripe.

- Contactless payment cards are equipped with near-field communication (NFC) technology that allows payments to be made at a terminal without having to swipe or insert the card. Because you simply tap the card on the terminal’s NFC sensor — or wave it close to the sensor — these transactions are typically even faster than with an EMV chip. Contactless cards also create a one-time code unique to each transaction, so they’re just as secure as EMV chip-equipped cards.

- Smart device payments skip the physical card altogether. You just add your credit or debit card to the digital wallet app of your smartphone, smartwatch or tablet. Then you can use the NFC payment terminal at participating merchants by tapping your device or holding it near the contactless icon.

Bottom Line

Money is a tool, and the key to getting the most out of a tool is using it correctly and optimally. Trying some of these tips could lead to gains that inspire you to go even further in getting more from your money.

Since building credit requires making on-time payments and keeping your utilization low, you may want to consider getting a new card. Just be sure to see if you pre-qualify and compare credit card options before applying.